As the new year approaches, people are sharing their trend predictions, from fashion and entertainment to politics and science. With our focus on emerging climate fund managers, the ICFA has a front-row view of what the most innovative impact finance actors are experimenting with today, and what’s likely to be hot (or not) in the years ahead. Now that we’ve reviewed applications for our 2026 cohort, we’re ready to make a few calls.

As the new year approaches, people are sharing their trend predictions, from fashion and entertainment to politics and science. With our focus on emerging climate fund managers, the ICFA has a front-row view of what the most innovative impact finance actors are experimenting with today, and what’s likely to be hot (or not) in the years ahead. Now that we’ve reviewed applications for our 2026 cohort, we’re ready to make a few calls.

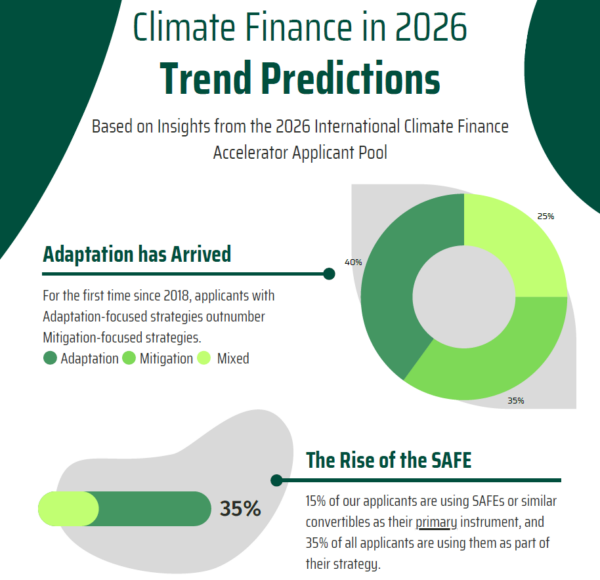

Prediction #1 – It’s not just talk, Adaptation has arrived

For the first time in our programme’s history, Adaptation-focused funds outnumber Mitigation-only strategies.

This year, 35% of applicants had Adaptation first/only strategies and 40% had a relative balance between mitigation and adaptation

This doesn’t mean mitigation is “out,” but it means the market is finally pricing in the fact that climate impacts are already here and need to be managed. Capital is moving toward resilience, food systems, water, infrastructure, and the messy middle of the real economy.

Prediction #2 – The Rise of the SAFE

Quietly but clearly, SAFEs (Simple Agreement for Future Equity) and SAFE-like futures structures are breaking out of their early-stage box in impact.

We saw 15% of our applicants using SAFEs or similar convertibles as their primary instrument, and that’s before counting those using them in addition to primarily debt or equity. This feels like a response to the reality of climate sectors—uncertainty, longer timelines, and the need for flexibility.

If you’re forming or financing a fund in 2026, convertibles are moving from “creative” to “completely normal.”

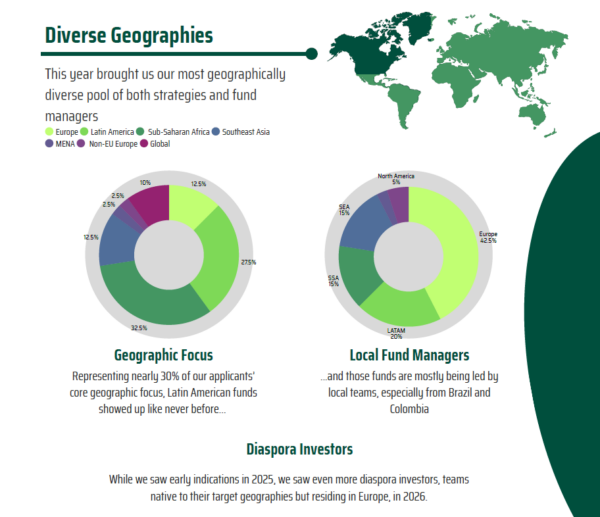

Prediction #3 – LatAm – The Comeback Kid

Representing nearly 30% of our applicants’ core geographic focus, Latin American funds showed up like never before. But we don’t think this is a sign that fundraising has become easier in the region. With concessional and early catalytic capital tightening, and long-standing DFI attention still heavily skewed toward Africa, LatAm remains one of the harder regions to fundraise for. What we’re seeing instead looks like a response to a real financing gap, combined with a maturing local talent pool. Notably, LatAm applications this year (as well as last year) are led primarily by regional managers headquartered in Colombia and Brazil. Taken together, this suggests a shift toward locally driven fund formation with managers building vehicles designed for their markets’ realities, even in the absence of abundant capital.

Prediction #4 – Emergence of Local Managers

Prediction #4 – Emergence of Local Managers

Roughly half of our applicants are based in emerging markets, with the other half based in Europe or North America. This includes the 12% of our applicants investing in Europe, making 64% of our applicant pool “Local Managers” native to and resident in their target geography. Latin America stands out in particular; most LatAm-focused funds this year are led by Latin American managers, and all of our Southeast Asia–focused applicants are managed by SEA-based teams. This points to a broader shift toward locally anchored fund formation, where managers are building vehicles from within their target markets rather than exporting strategies from afar, a trend that has meaningful implications for fund design, governance, and ultimately capital deployment.

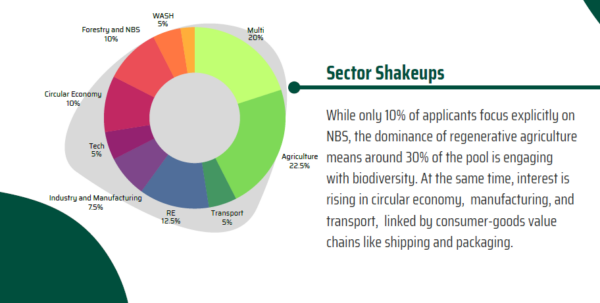

Prediction #5 – Biodiversity on the Rise

While 10% of our applicant pool has nature-based solutions strategies, this undersells how prevalent biodiversity is becoming as a climate finance theme. Our largest sector was agriculture but interestingly, the vast majority of those agriculture funds were focused on regenerative models, from silvopasture and soil health to diversified production systems, making biodiversity central to those strategies. Adding in forestry and early experimentation with biodiversity credits, roughly 30% of our applicant pool is proposing a biodiversity strategy. Now the challenge is for markets and standards to catch up with this early momentum!

Prediction #6 – Greening Consumer Goods

While the raw data shows us that multi-sector and/or opportunistic strategies are at the top, followed closely by an abundance of regenerative agriculture strategies, we’re also seeing growth in circular economy, industry & manufacturing, and transport. While each of those sectors looks small on its own, we observed that the fund proposals we received mostly shared a focus on consumer-goods value chains (think shipping, packaging, processing). Having 10% of our applicants focusing on circular economy was already interesting, but having nearly a quarter of applicants with consumer goods adjacent strategies is something we haven’t seen yet (and are really excited about).

Prediction #7 – Counterintuitive Fund Sizing

40% of our applicants declared target raises of €100 million or higher and we saw a notable number of proposed funds with target sizes over €200 million, an often-unwieldy size for emerging managers. This runs counter to the advice we give to start small. What’s striking is that many of these large fund proposals are coming from teams that have not previously run a smaller pilot or proof-of-concept vehicle. By contrast, managers launching more modest first funds (€10-50 million) often show the opposite patter with: a progression from even smaller pilots, sidecars, or managed accounts. Heading into 2026, we expect increasing tension between ambition and sequencing, and a growing premium on managers who can demonstrate credible pathways from small-scale experimentation to institutional scale.

If there’s a throughline, it’s this: funds are designing for how the world actually works. Flexible instruments, adaptation-first theses, multi-sector strategies, and locally rooted managers aren’t edge cases anymore. After a tumultuous 2025, the market is recalibrating. Heading into 2026, these are the trends we’ll be paying closest attention to.