Accelerating Impact and LuxFLAG, both active actors in impact finance, decided to join forces to develop a stronger foundation to formulate a Social Impact Investing Definition, to launch a related Social Investment Framework, and to nurture the development of social investment products.

This shared definition and framework serves as a cornerstone for advancing our respective activities. Accelerating Impact and LuxFLAG have both witnessed increasing demand for financial products classified as social impact investing and the need for a clear definition.

Both initiatives provide, as part of their mission, support to investment products that focus on achieving measurable social outcomes alongside financial returns. By setting clear standards and providing meaningful recognition, these efforts aim to encourage greater alignment of capital flows with social objectives, driving the growth and legitimacy of the social investing ecosystem.

In recent years, most attention has been focused on tracking and defining environmental and climate finance. This has been driven by a variety of factors, including an increased focus and pressure on financiers and their investees to report on climate impact and increased regulation on sustainability and climate reporting. Climate finance benefits from well-established international commitments and tracking mechanisms, which provide guidelines and standardized metrics for measuring impacts like carbon emissions reductions.

In comparison, the measurement and reporting of social finance are not as developed due to the complexity and diversity of social issues compared to the more narrowly defined environmental metrics. Social finance encompasses a broad range of outcomes, from health and education to social inclusion and poverty alleviation, making it challenging to create uniform measurement standards. Additionally, social impacts are often more qualitative and context-specific, requiring nuanced approaches to capture the full extent of their effects. This complicates the development of consistent reporting frameworks, thus hindering social finance flows.

Our methodology to build a shared definition and framework involved a review of prior work, comprehensive literature review and research, the creation of the framework, consultations with practitioners to elicit feedback, and finally dissemination of the research. This approach ensured that our framework not only integrates theoretical insights but also addresses practical considerations and challenges on the ground, paving the way for a more cohesive approach to determining our Social Impact Investing Definition and creating a Social Investment Framework.

Considering a growing dialogue on existing social inequalities and a growing recognition of the need to address the social implications of the ongoing transition to a low-carbon economy, social impact investing is experiencing rising demand and interest, as evidenced by several emerging trends. Notable among these are the development of new financial instruments designed for social impact investing, a proliferation of funds with a social lens, increasing investment volumes in the field, and rising interest from institutional investors in allocating portions of their portfolios to impact investments.

To increase credibility and boost investment into the social impact finance sector, greater clarity around a shared definition and a standardized categorisation of activities would be beneficial. We propose the following definition for Social Impact Investing:

Our Social Impact Investing Definition Social Impact Investing is the financing of social activities made with the intention to generate measured and managed substantial positive impact, while avoiding or mitigating negative impact, alongside a financial return.

Social activities include those that promote access to or whose objective is to promote decent work across the value-chain, adequate living standards and wellbeing, and/or inclusive and sustainable communities.

In this proposed definition, we include key terms such as eligible social activities, intentionality, measurability and transparency, substantial positive impact (implicitly including target populations and additionality), negative impacts (covering exclusions and minimum safeguards), and financial return.

We provide with greater detail around our rationale to include each of the key terms in our definition as well as the alignment with other frameworks’ definition.

While many activities may yield incremental or modest social benefits, achieving true transformation requires a Substantial Impact. This means that any activity should specifically target an unmet need experienced by a population group or deliver significant benefits to the broader population through its product or service.

Given the variability in qualifications that define what constitutes a substantial impact, we have further elaborated on the concept in our research paper.

At a fundamental level, eligible social investment must address an unmet need in line with the Availability, Accessibility, Acceptability, and Quality (AAAQ) Toolbox (Danish Institute for Human Right, n.d.): by 1) providing a good or service that is otherwise unavailable, 2) reducing barriers to accessing a good or service, 3) increasing the individual and cultural acceptability of a good or service, and/or 4) increasing the quality of a good or service.

Furthermore, certain social activities may have a positive impact when directed at specific population groups, yet the same activities might offer limited benefits in addressing the needs of other groups. This underscores the critical importance of defining Target Population accurately.

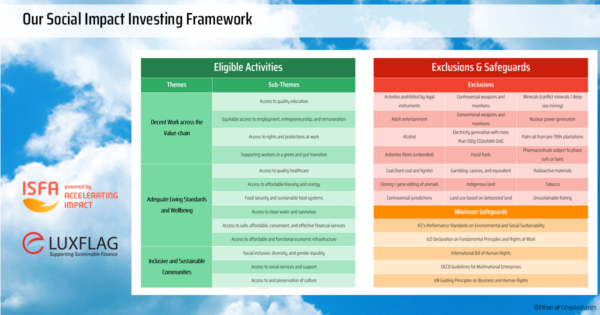

As part of the framework, we mapped out which social activities various market practitioners qualify as eligible. We chose to adhere to the proposed EU Social Taxonomy structure (Platform on Sustainable Finance, 2023) by categorizing these activities in the three following themes:

– Decent Work across the Value-Chain,

– Adequate Living Standards and Wellbeing, and

– Inclusive and Sustainable Communities.

For each theme, we share a list of example activities that would qualify under Social Impact Investing. These non-exhaustive lists of activities were identified during our review of existing frameworks, taxonomies, and financial products, and categorized in the proposed themes and sub-themes. The table on the next page also highlights this categorization at a higher level.

To consider the potential negative impact of any Social Impact Investing activity and to ensure adherence to social and environmental standards, we also set out suggested lists of Excluded Activities as well as Minimum Safeguards. Similarly, these lists were based on extensive review of existing frameworks. These are also included in the table below.

The following table provides a concise yet comprehensive picture of the Social Investment Framework.

Download the complete version of the Social Investment Framework